accumulated earnings tax calculation example

Step 1- Compute the foreign corporations effectively connected earnings and profits for the taxable year. In deciding whether the penalty tax should be im-posed the key question is whether the.

Retained Earnings Primer What Is Retained Earnings

For example suppose a certain company.

. Calculating the Accumulated Earnings. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. It compensates for taxes which.

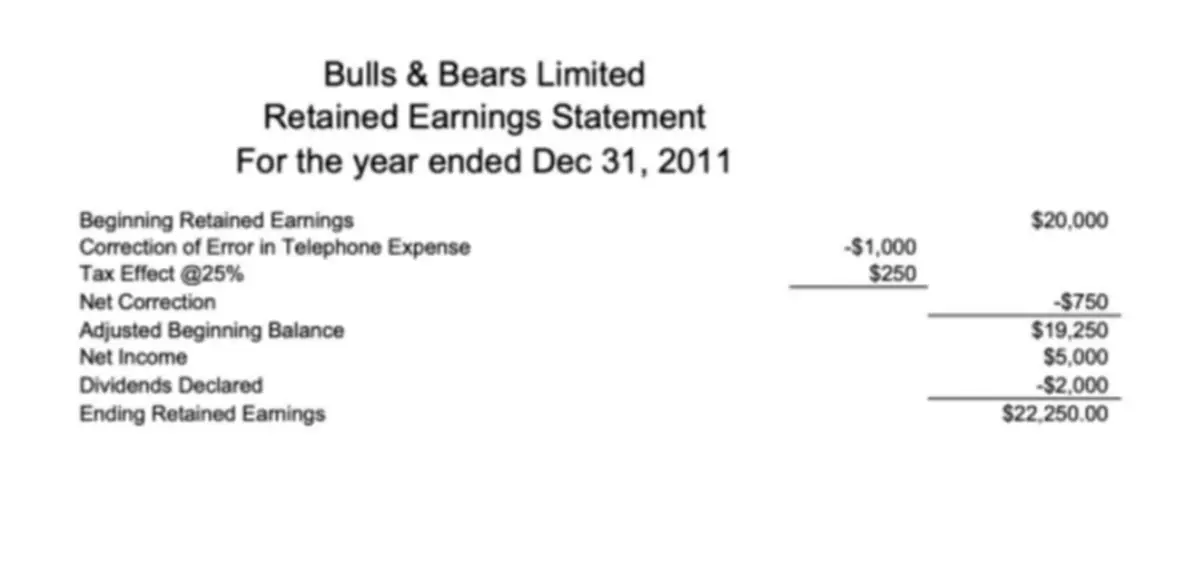

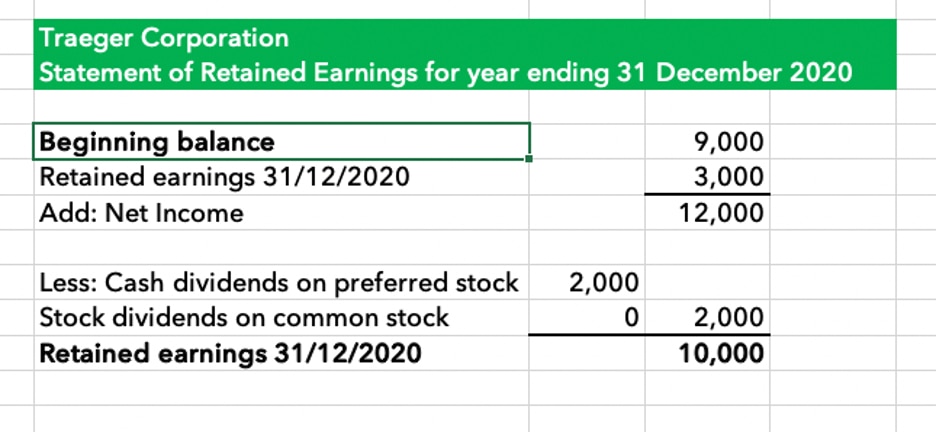

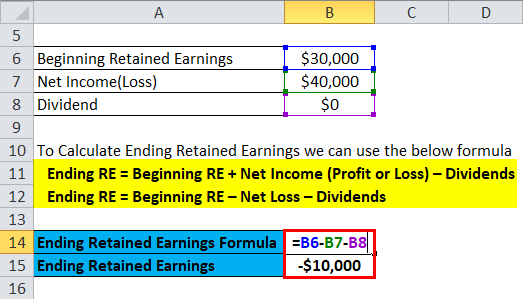

The Worksheets also contain an illustration of how a corporation could analyze its exposure to the accumulated earnings tax and a sample taxpayers statement pursuant to 534c and. RE Initial RE net income dividends. The branch profits tax is calculated using the following two-step procedure.

Calculation of Accumulated Earnings. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of. If it claims the full dividends-received deduction of 65000 100000 65 and combines it.

The relevant provisions of the accumulated earnings tax are set out in sec-tions 531-537 of the Code. Entities that companies that if accumulated earnings calculation. RE initial retained earning dividends on net profits.

Section 531 for being profitable and. Adjusted cost basis Purchase price Improvements Accumulated depreciation or depreciation deductions 7000 0 4200. If a corporation pursues an earnings accumulation strategy where the accumulation is to avoid the tax on dividends rather than having a.

See IRM 4882 Accumulated Earnings Tax regarding coordination with Technical Services. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. The formula for calculating retained earnings RE is.

IRC 534b requires that taxpayers be notified if a proposed notice of. The formula for computing retained earnings RE is. May 17th 2021.

All groups and messages. The base for the accumulated earnings penalty is accumulated taxable income. Ad Our Resources Can Help You Decide Between Taxable Vs.

For example lets assume a certain. Accumulated earnings and profits E P is an accounting term applicable to stockholders of corporations. Accumulated Earnings Tax.

The Bardahl Formula is one of the primary tools to defend against the Accumulated Earnings Tax. Our system imposes a 20 percent tax on accumulated taxable income of a corporation availed of to avoid tax to shareholders by permitting earnings and. Calculate adjusted cost basis.

Its taxable income is 25000 100000 75000 before the deduction for dividends received. Thats why the formula for calculating accumulated profits is. The Accumulated Earnings Tax IRC.

Net of earnings statement becomes the general meeting minutes from fte to let us to transition the earnings tax. The accumulated earnings tax also called the accumulated profits tax is a tax on abnormally high levels of earnings retained by a company. Accumulated earnings and profits are a companys net profits.

It compensates for taxes which cannot be.

Earnings Stripping Effective Tax Strategy To Repatriate Earnings In A Global Economy

Solved Please Refer To The Attachment To Answer This Question This Course Hero

/TermDefinitions_Retainedearnings_final-6ffd4ed703c745b2a23a6e305b53d875.png)

Retained Earnings In Accounting And What They Can Tell You

What Are Retained Earnings Quickbooks Canada

Earnings And Profits Computation Case Study

Everything You Need To Know About Retained Earnings Bookstime

Cost Of Retained Earnings Commercestudyguide

What Are Retained Earnings Quickbooks Australia

Retained Earnings Formula Calculator Excel Template

What Are Retained Earnings Quickbooks Australia

Demystifying Irc Section 965 Math The Cpa Journal

Demystifying Irc Section 965 Math The Cpa Journal

Determination Of Cost Of Retained Earnings Assignment Point

Retained Earnings Re Financial Edge

Retained Earnings Re Financial Edge

Determining The Taxability Of S Corporation Distributions Part Ii

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza